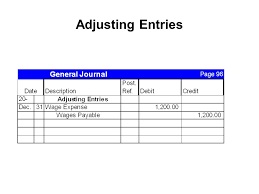

Within the accounting process, many economic activities exist which might not instantly call for the recording of the transaction. These transactions are catered for through adjusting entries which act to stand for the revenues and expenses within the accounting period that they resulted. There are two instances of adjusting entries first deferrals in this case it keeps expenses and revenues which might have been recorded but then need to be deferred to some other period.

For instance deference of some insurance cover which was paid for towards the term of an accounting period for subsequent coverage’s within the next period. Some deferred entries are noted down to reveal the insurance expenses within the period that the insurance cover is applicable.

The other instance is accruals which apply to expenses and revenues which have been accrued but not recorded yet. For instance the revenue interest which has been earned within one period despite the real cash payments have not been received till early in the period that follows. Entry adjustments are effected to take note of the revenues within the period that were earned.

These journal adjustments are normally made towards the end of an accounting period so as to update the balances of accounting in reflecting accurate balances according to the balance sheet, the accounting period end date. The differences of timing in cognizance of expenses and revenues between accrual foundation as well as cash accounting basis are often corrected through journal entries adjustments.

It is in reality a nice and helpful piece of info.

I’m glad that you just shared this useful info with us. Please keep us up to date like this.

It is in reality a nice and helpful piece of info.

I’m glad that you just shared this useful info with us.

Please keep us up to date like this. Thank you for sharing.