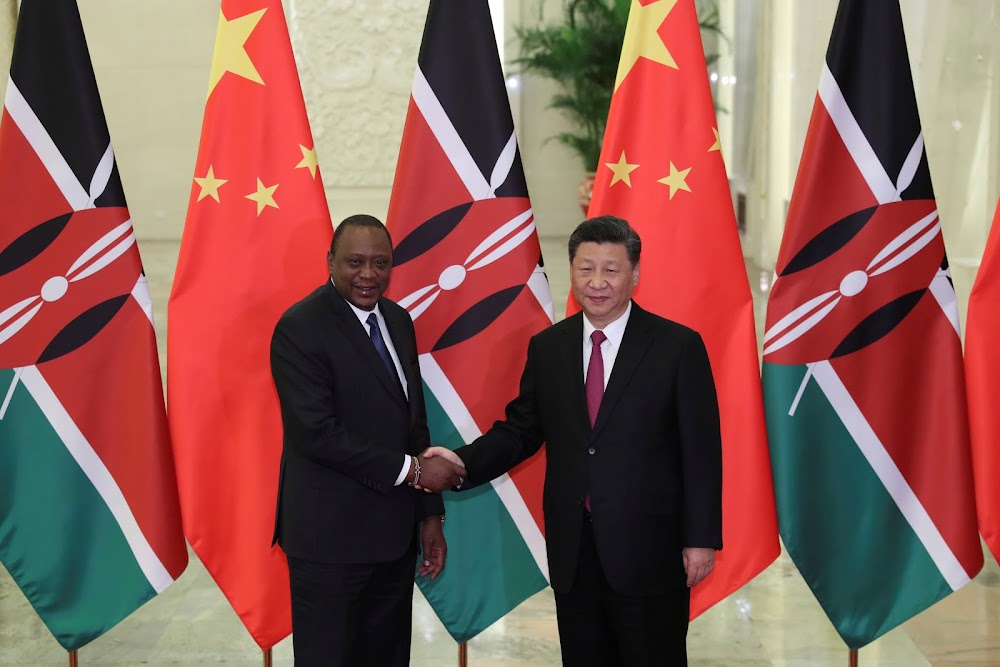

Let me show you how Uhuru Kenyatta ruined Kenya’s economy with unsustainable loans. But Ruto must create a conducive business environment to mitigate against the imminent collapse. Let me take you through the mess Uhuru created and how Ruto must navigate through it. When Uhuru took over power in 2013, Kenya had accumulated only KES 1.8 trillion debt.

In just 4 years, Uhuru borrowed KES 2.7 Trillion. Therefore, Kenya’s debt rose from KES 1.8 Trillion in 2013 to KES 4.5 Trillion in 2017. This means that Uhuru borrowed an amount higher by KES 700 Billion to that borrowed by 3 Presidents in 55 year, in just 4 years! Although this level of borrowing seemed extreme, developmental projects were visible. To the extent that almost 70% of what Uhuru achieved in his 10 years’ in power, is attributable to his 1st term in office.

Which was characterized by SGT project, the unsuccessful school laptop program, more than 5000km of tarmac road, nation-wide last mile electricity and wanton corruption. However, it’s worth noting that the economy grew from KES 5.3 Trillion in 2013 to KES 8.48 Trillion by the end of his 1st term in 2017. This would mean that, potentially, the capacity to repay may have expanded.

From 2018 to 2022, Uhuru borrowed a whooping KES 4.5 Trillion which was mainly to finance the botched BBI initiative to change the constitution. Apart the Nairobi’s PPP express way project, the Trillions of shillings borrowed in Uhuru’s 2nd term in office will remain a bitter pill to swallow. This led to the collapse of the shilling and inability to repay the Trillions of shillings whose grace period for repayment was coming to and end after 2022. The devaluation of the Kenya shilling spells doom for Kenya as the economy shrinks by more than 44% in dollar value.

This means that, repayment of existing loans in dollars, will be difficult and daunting for Ruto’s government. Adjusting the economy to the realities of the current value of the shilling, means pain and economic disarray. Kenya is in trouble. Salaries must increase and imports must be curtailed. For the economy to survive, government should spur economic activity by creating an extremely conducive policy environment for both local and direct foreign investment .

This is not the time to increase taxes and levies, nor the time to muzzle private business enterprises with punitive regulatory hurdles. Instituting layers of regulatory requirements with revenue lenses will not help the economy through this crisis. Ruto must stop increasing taxes. Ruto must not agree to IMF and World Bank’s condition to increase taxes and devalue the shilling further. The current explanation by the CS treasury and the CBK governor that the shilling is finding it’s true value is a lie. Just do the right thing. Defend Kenya, defend our sovereignty.

Protect our economy by all means. We have dent to pay and an economy to grow. A weak Kenya shilling will stall everything. Let Ruto know that Kenyans understand the difficulty he is facing, but they too know that he is not new to these realities. He was in the system when they happened. Ruto must listen to the voice of the people.